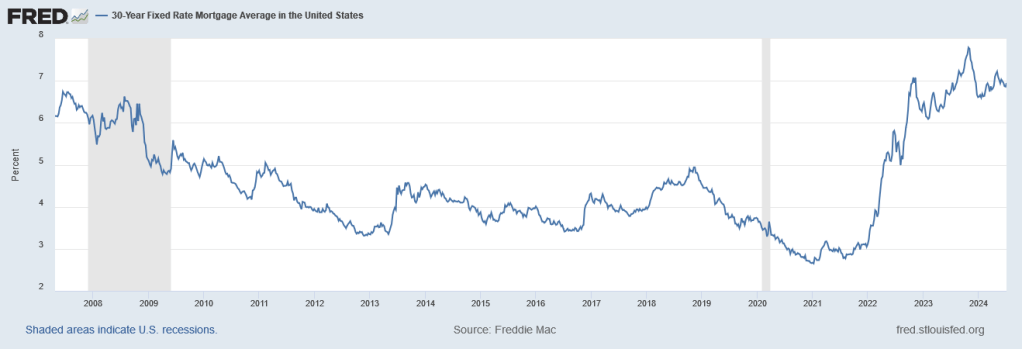

Three years ago, I penned a post (linked here) forecasting the potential repercussions of a hypothetical scenario where mortgage rates doubled due to Federal Reserve rate hikes. Now, with that time elapsed, let’s reflect on what predictions were accurate and where I missed the mark.

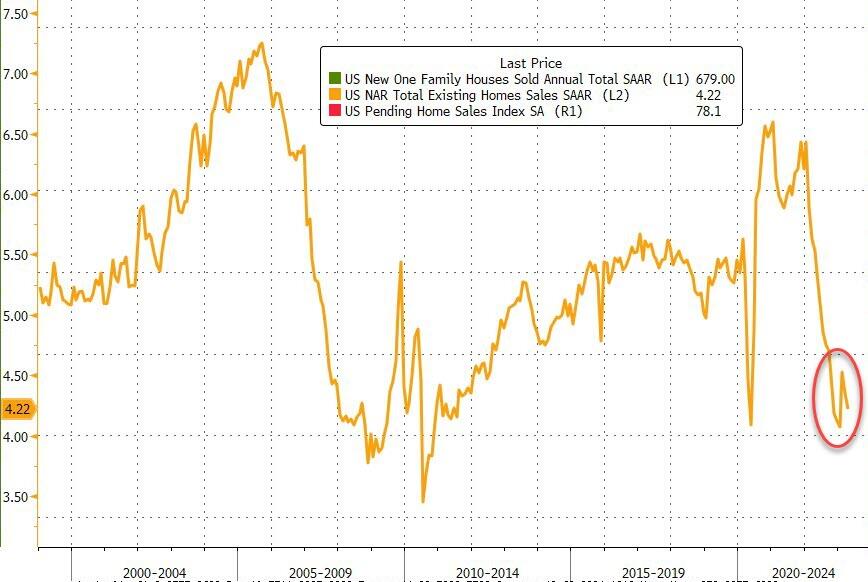

The impact on the housing market has been clear. Back on May 3, 2021, the average mortgage rate stood at a modest 2.96% for a 30-year traditional mortgage, with the Fed yet to embark on its inflation-curbing rate hike cycle. Existing home sales were robust, pacing at 5.8 million units, and despite concerns about exuberance, the market was deemed “healthy” before the anticipated impact of

Fast forward to today, and the landscape has dramatically shifted. Mortgage rates have surged by 400 basis points to 6.95%, coinciding with a sharp decline in existing home sales to 4.1 million units. This marks a level not witnessed since the aftermath of the 2008 Great Financial Crisis.

What I Accurately Predicted:

Crucially, my 2021 analysis correctly anticipated that housing affordability would become a pressing issue for many Americans. The rapid ascent in mortgage rates effectively priced out aspiring homeowners or significantly increased their financial burden compared to the days of 3% rates.

Average payments on a median priced home jumped from $1,100 a month back in 2021 to a whopping $2,800 a month! More than doubling due to the effect of both rates and home price inflation. Back in 2021 I only predicted a now modest rise in payments to $1,500 a month.

Looking back, it’s clear to see why the housing market has stalled and why economic sentiment remains grim for the half of Americans who didn’t secure a mortgage at 3%.

Where I Missed the Mark:

Admittedly, my assessment back in 2021 underestimated the significant role of cash in the market. Whether sourced from stimulus funds, previous home sales, or substantial equity gains from an era of low interest rates, cash buyers have emerged as pivotal players in sustaining the market. Their presence has prevented a total collapse despite adverse conditions.

What Lies Ahead:

Looking forward, two primary forces will shape the housing market’s trajectory. Firstly, the sustainability of cash buyers in this high-rate environment remains a critical question. As their resources dwindle, the potential for a rapid decline in home prices increases, driven by motivated sellers looking to offload properties.

Secondly, the Federal Reserve’s actions will exert considerable influence. As of July 2024, there are indications that the Fed may soon reduce rates. Logically, one might expect mortgage rates to follow suit, but the aftermath may not be straightforward. Banks, still cautious from recent instability exemplified by the failures of major institutions like Silicon Valley Bank, may not rush to resume aggressive lending practices. Consequently, any recovery in mortgage rates and the housing market may not mirror the pace of Fed rate cuts. Additionally, the Fed could be navigating a recessionary landscape, complicating their policy decisions.

In summary, while some predictions held true, the market’s resilience to cash buyers and the unpredictable interplay of economic factors illustrate the complexity of forecasting in the ever-changing realm of real estate and finance.

Categories: Uncategorized

Leave a comment