The Path of Inflation

Inflation saw it’s highest print since 1982 in December. CPI inflation came in at a whopping 7% y/y as supply chain issues caused by Covid cases and mandates seized the economy to a halt amongst a glut of cash spewing from the printers in J. Pow’s basement.

Potential for runaway inflation has finally cemented its status as the Fed’s #1 priority. Official unemployment is back at historic lows and as much as the Fed wishes, it cannot solve climate change and other social issues by printing money. At least not legally. So it is natural to discuss what effect the Fed’s inflation fighting tools may have and when we will see a stop to these parabolic price moves.

Most economists are thinking about inflation being a one-time move. Factors that have caused it, massive money supply increase coupled with no significant increase in production (supply chain issues), will subside and the Fed’s inflation-fighting tools will bring down inflation and we can get back to normal. Sounds kind of like how Covid would peak and go away, right?

Much like Covid, I believe we are going to experience waves of inflation. Also like Covid, this first wave might be the mildest.

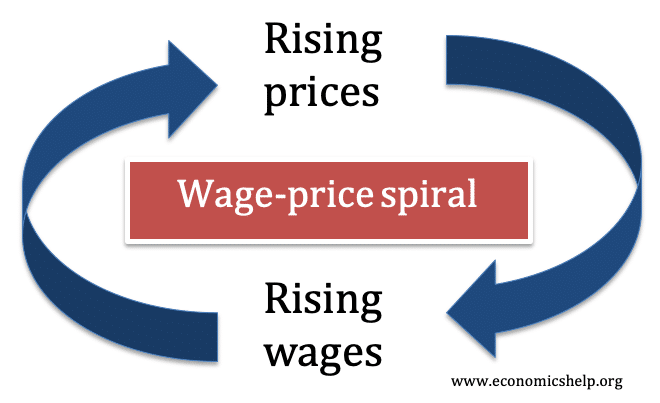

The reason for my view of expected waves of inflation is attributed to the phenomenon called the Wage-Price Spiral. The Wage-Price Spiral is what you get when workers see prices rising all around them so they seek higher wages to compensate. Whether that’s through asking for a raise at their current job or seeking entirely new employment but at a higher wage.

We certainly see the latter today. Drive around any city and you will see “Now Hiring” signs with signing bonus and starting wages that would make your high-school summer job self drool! These high salaries do not come at the business owner’s expense. They will pass this on to consumers and will not take a single point off their margin. Thus, prices increase again.

We are already seeing that take place today but what we are missing are salaried employees reacting to this recent influx of inflation. Workers, including salaried ones are quitting at the fastest pace ever. Job postings are reacting to this by raising starting salaries in an effort to maintain competitiveness. However, this is still a smaller demographic of workers. The largest group remained employed through out. And yearly raise season is coming.

Most employers negotiate salaries as the new year starts. This year we are already hearing stores about companies raising salaries in an effort to keep workers from jumping ship. This first-reaction to inflation has set in already. Regardless of what the Fed’s tools may think they accomplish.

So we have seen the first wave of the Wage-Price Spiral take place. Much like in the Spring of 2020, when we thought Covid had subsiding only to see it rear its ugly head in a larger second wage, expect the second wave of inflation to be bigger.

The second wave of inflation will be much larger than the current wave we are experiencing. While the current wave is large, it is based on raw good inputs and shipping costs. For most businesses the biggest expense they have is labor and as described, cost of labor just went way up!.

So as 2022 moves along, companies will be raising prices reacting increasing employment costs in addition the cost pressures they have been feeling for the last few years. And as described, rising prices lead to workers asking for higher wages, we’re spiraling and there is not much the Fed can do!

Leave a comment