August 23-27, 2021 Review

Here’s a look at the key news and data releases from the past week.

First the economic news. The key news story from the economic front last week happen in the Pacific. Specifically that despite being the largest body of water on earth, the ports in China and the U.S. west coast are bogged down. This will cause ‘transitory’ inflation to continue to spike, and gives the Fed an out for calling inflation temporary for a few more months. There was good news that a port in China that was closed for COVID cases, was back up and running.

Now to the data.

IHS Manufacturing Survey:

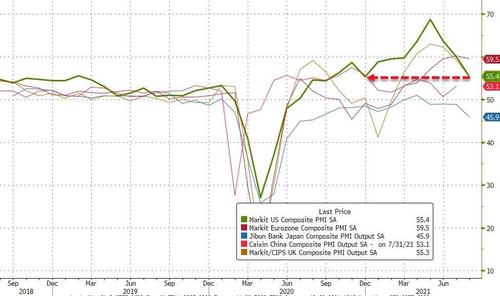

COVID’s resurgence and the continuing supply chain bottlenecks contributed to a loss of confidence in the manufacturing sector. The index dipped to 61.2 from 63.4 last month. Also reflected in the dip were continuing labor shortage problems where businesses couldn’t find workers to fill open positions.

IHS Service Survey:

The PMI Service survey collapsed due to the prospects of a slowing economy. Falling over 4 pts, the index fell to 55.2, down from 59.9 last month and well below expectations for a small decline. The service industry had been enjoying a recovery as government mandates allowed customers to get back and visit businesses, new mandates and fear of new mandates are causing business owners to once again fear for what is ahead.

Existing Home Sales:

Expecting to come in around 5.9MM, home sales in July came in a little above expectations at almost 6MM even. Mortgage rates at historic lows drove buyers to the market which was only constrained by low inventories. High-end homes costing more than $1 million have been exploding higher will affordable homes less than $250k are nowhere to be found, down -30% y/y. This report continues to show the effect of people moving out of the city and millennials looking for their first home. Supply of cheap homes continues to be low and builders should have plenty of demand as long as rate stay this low.

Durable Goods:

Durable goods dropped an expected -0.1% m/m as the economy cooling and lower aircraft orders came in. The supply chain also continues to be haunting this data. Specifically semiconductor computer chips and the lack of supply of them. Is seems like most things today take computer chips and while they remain in short supply orders for durable goods will continue to be slower than what they could be. What could also be happening, business have been stocking up on everything. COVID changed the just-in-time economic where only a couple weeks of supply were held to one where now months of supply is kept on hand, in preparation for supply chain disruptions. We may be starting to see the negative effects of this. Business have enough inventory and are no longer stocking up.

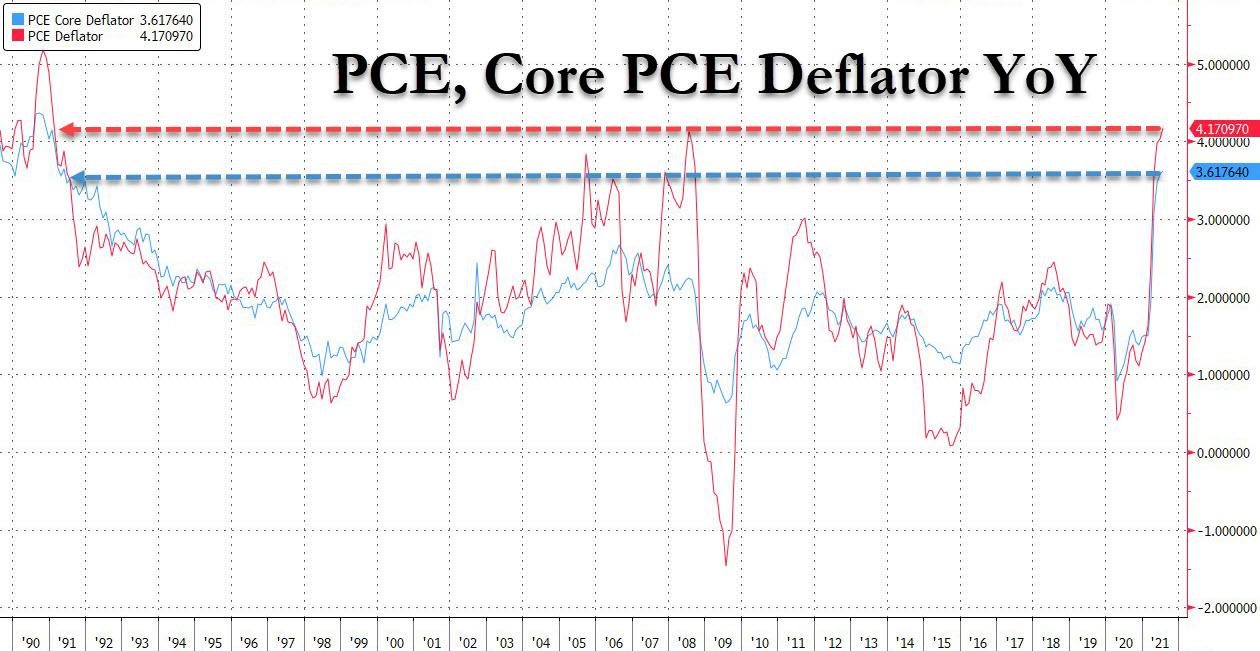

Personal Income and PCE Inflation:

Income grew in July from a combination of wages and government benefits. While government transfers were far last than during the brunt of the pandemic it did rise to its highest level since April when stimulus checks were last distributed. This month it is likely coming from the Childcare Credit from the American Rescue Plan. The savings rate increased to 9.6% as spending was subdued. For the economy to be back in full swing our consumer-based economy needs to be spending more.

On the inflation side, while the Fed continues to call it ‘transitory’ whatever you call it, Core PCE was historically high in July. Coming in at +3.6% y/y. The highest since July 1991 and well above the target of 2.0% inflation. While associated with base effect increases like hotels and airlines. Most categories were up and the Fed associates that with the supply chain.

That is all for this week. It is a chink in the armor of the recovery. The Delta variant doesn’t give me much hope when these numbers are released next month. Expect slower service sales, and congested supply chain, and inflation coming from core goods. Hotels and airline prices should retreat.

Categories: Weekly

Leave a comment